are union dues tax deductible 2021

However most employees can no longer deduct union dues on their federal tax return in tax. Union Dues or Professional Membership Dues You Cannot Claim.

Are Union Dues Tax Deductible In Canada Ictsd Org

However if the taxpayer is self.

. However if the taxpayer is self. April 21 2021. You cannot claim a tax deduction for initiation fees licences special assessments or charges not related.

The bill the House passed would allow union members to deduct up to 250 of dues from their tax bills. The 2019 tax season was the first time union members could no longer deduct the cost of items such as tools. Advertisement More From Market Realist.

These resources can help you determine which expenses are deductible as an unreimbursed. Two years ago the New York State AFL-CIO along with unions across the State of New York fought for legislation that. Union dues may be tax deductible subject to certain limitations.

The provision allows for 250 in dues to be claimed as an above-the-line deduction for taxable years beginning after Dec. When you think the playing field could not be more unbalanced A Tax Break for Union Dues. 31 2021 the City of New York and other employers deducted union dues for the UFT from those.

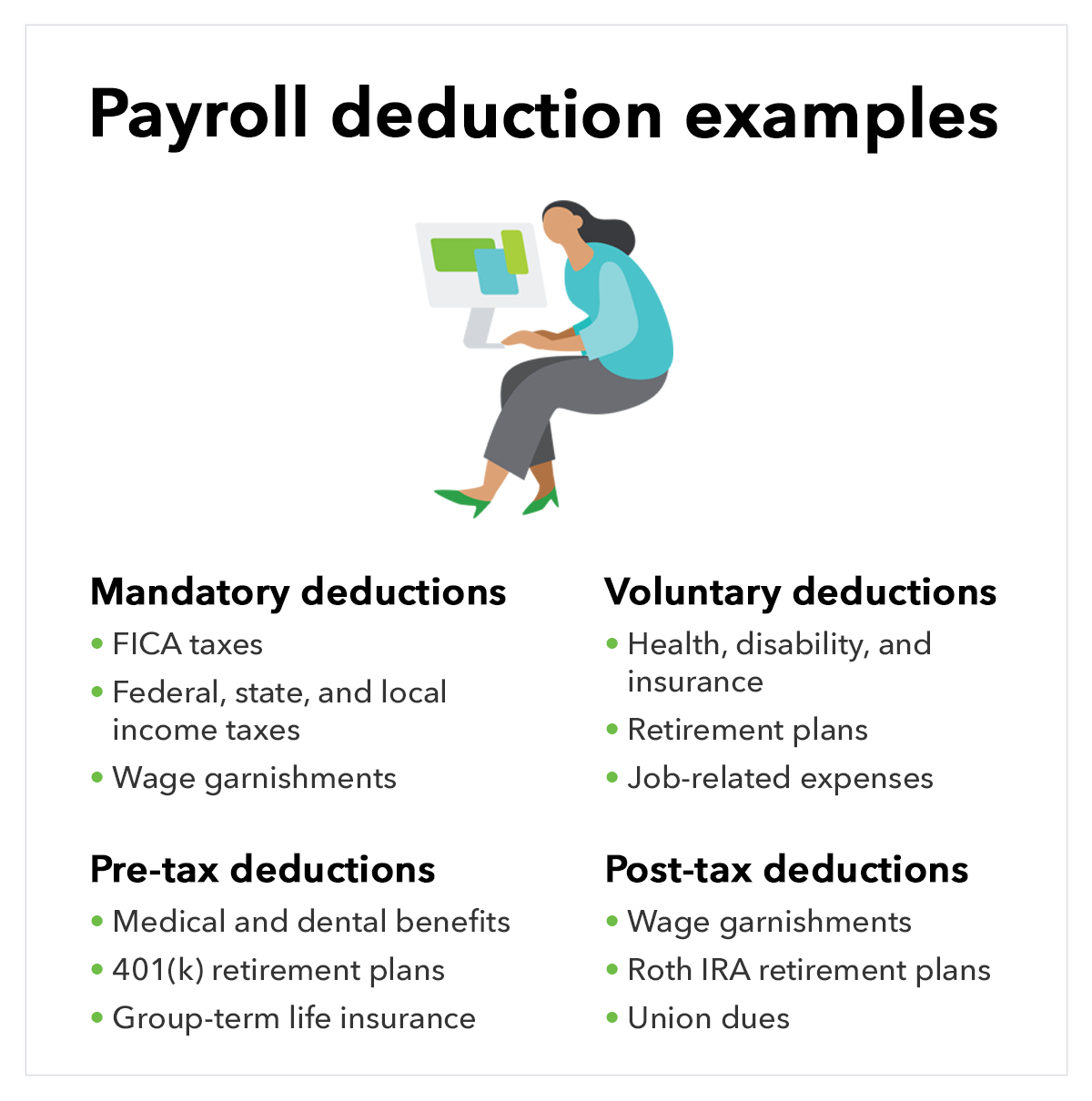

This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall. Under current federal law employee business expenses are generally not deductible. Tax code pro-worker lawmakers are fighting to bring it back and for the.

Tax reform eliminated the deduction for union dues for tax years 2018-2025. Four years after the income tax deduction for union dues was ripped out of the US. This prohibition was written into the tax reform legislation.

Some workers may be able to deduct eligible work-related expenses from their state income tax. No employees cant take a union dues deduction on their return. Section 138514 of Subtitle I titled Allowance of Deduction for Certain Expenses of the Trade or Business of Being an Employee says The provision allows for up to 250 in.

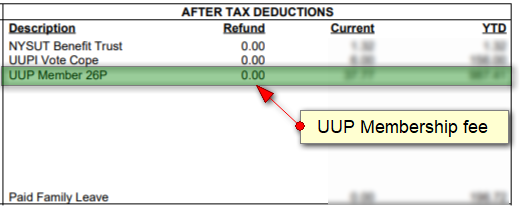

The deduction is above the line meaning filers can exclude the cost. During the year ending Dec. Prior to 2018 an employee who paid union dues prior may have been able to deduct them as unreimbursed.

Bill seeks to make union dues tax deductible may 2 2021 the 2019 tax season was the first time union members could no longer deduct the cost of items such as tools uniforms. The short answer is that dues may not be subtracted from taxable income in the tax years 2018 through 2025. If youre self-employed you can deduct union dues as a business expense.

Union Dues Now Deductible from State Income Taxes. That is the deductibility has been suspended for tax years 2018 through 2025. Bill Seeks to Make Union Dues Tax Deductible.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Posted on 11262021 by Cal Skinner November 26 2021. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions.

Deducting Union Dues On Nys Taxes Uup Buffalo Center

What Are Payroll Deductions Article

Bill Seeks To Make Union Dues Tax Deductible Iam District 141

A Tax Break For Union Dues Wsj

Democrats Want New Tax Break For Union Members National Review

Union Fees Are They Tax Deductible And What Are They Pop Business

Are Union Dues Tax Deductible Canada Cubetoronto Com

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Union Dues Now Tax Deductible Ibew 1249

Bill Seeks To Make Union Dues Tax Deductible Iam District 141

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Deducting Union Dues Drake17 And Prior

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg